Now Reading: Beyond Section 80C: A Complete Guide to Tax Optimization for Salaried Professionals in India

-

01

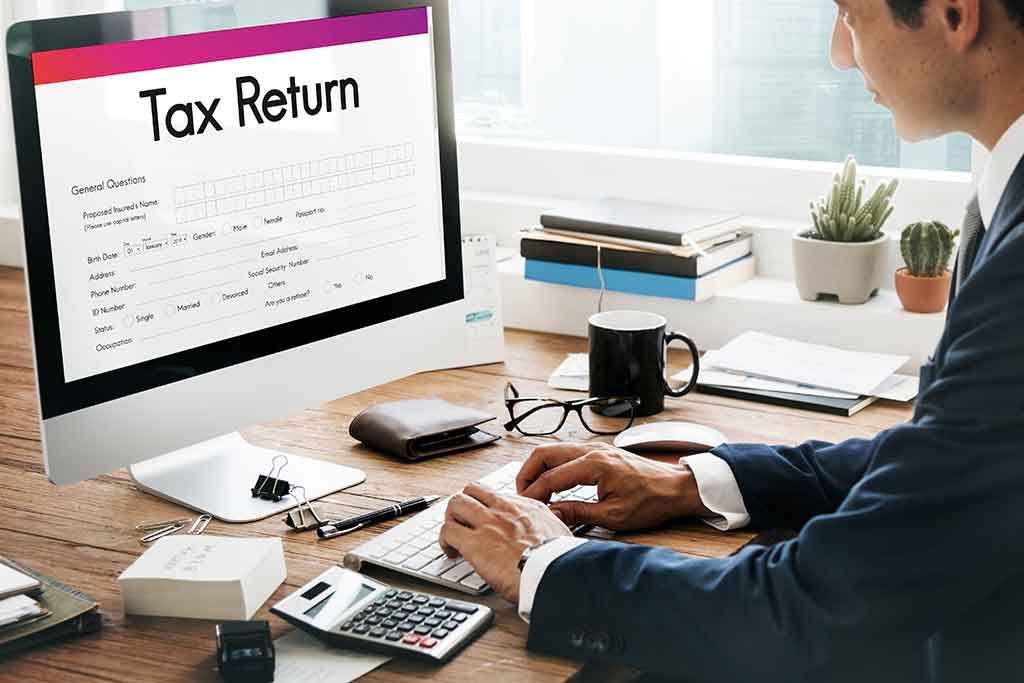

Beyond Section 80C: A Complete Guide to Tax Optimization for Salaried Professionals in India

Beyond Section 80C: A Complete Guide to Tax Optimization for Salaried Professionals in India

Move beyond basic 80C investments! This guide reveals powerful tax optimization strategies for salaried professionals. Learn to leverage HRA, NPS, health insurance, and home loans to significantly reduce your taxable income and build long-term wealth, all within the legal framework of the Indian tax system.

For most salaried professionals in India, the term “tax saving” is synonymous with Section 80C. As the financial year draws to a close, there is a mad rush to invest ₹1.5 lakh in PPF, ELSS, or insurance policies to claim that deduction. While utilizing Section 80C is a fundamental and crucial step, it is merely the first chapter in the story of smart tax management. If you stop there, you are leaving significant money on the table.

True financial wisdom lies not just in saving tax, but in tax optimization—structuring your finances in a way that your overall tax liability is legally minimized, not just for one year, but throughout your career. This involves understanding and leveraging a host of other sections in the Income Tax Act that are designed to reward specific financial behaviors, from renting a home and securing your health to planning for retirement.

This guide is designed to take you on a journey beyond the familiar territory of Section 80C. We will explore the powerful deductions and exemptions that can collectively save you lakhs of rupees more, transforming your approach from a last-minute scramble to a strategic, year-round financial plan. Whether you are in your twenties just starting out or in your fifties planning for retirement, these strategies are essential for keeping more of your hard-earned money.

The Foundation: Understanding Your Salary Structure

Before we dive into the specific strategies, it is vital to understand a simple principle of the Indian tax system: some components of your salary are fully or partially exempt from tax. The way your salary is structured can have a massive impact on your take-home pay and tax outgo.

Many employees make the mistake of only looking at the “Cost to Company” (CTC) figure. However, a smart professional looks at the breakdown. A salary structure rich in tax-exempt allowances is far more beneficial than one with a high basic salary. When you negotiate your salary or during internal appraisals, it is wise to ask for a restructuring to include more of these exempt allowances. This is the first and most powerful step in tax optimization.

The Rent Advantage: Mastering the House Rent Allowance (HRA)

For millions of salaried Indians living in rented accommodations, the House Rent Allowance (HRA) is one of the most valuable tax exemptions. It is not a standard deduction; the exemption is calculated as the minimum of the following three amounts:

- The actual HRA received from your employer.

- The actual rent you pay minus 10% of your basic salary (Basic + Dearness Allowance).

- 50% of your basic salary if you live in a metro city (Delhi, Mumbai, Chennai, Kolkata), or 40% for other cities.

To claim this benefit, you must provide rent receipts to your employer. If your annual rent exceeds ₹1 lakh, you are also required to provide the Permanent Account Number (PAN) of your landlord. What if you do not receive HRA from your employer? You can still claim a deduction for the rent you pay under Section 80GG, subject to certain conditions, though the limits are not as generous as the HRA exemption.

Securing Your Health and Your Wealth: The Power of Section 80D

Your health is your most valuable asset, and the government provides a strong incentive to protect it. Under Section 80D, you can claim a deduction for the premiums you pay for health insurance for yourself and your family.

The structure here is layered and highly beneficial. You can claim up to ₹25,000 for health insurance for yourself, your spouse, and your dependent children. If you are also paying for insurance for your parents, you can claim an additional ₹25,000. This limit is enhanced to ₹50,000 if your parents are senior citizens (above 60 years of age). Furthermore, the section allows an additional deduction of up to ₹5,000 for preventive health check-ups for you and your family, which is included within the overall limits mentioned above. This makes a strong case for going for an annual health check-up, paid for through your health insurance or out-of-pocket. It is a classic example of a provision that promotes well-being while offering financial savings.

Building a Pension-Friendly Future: The National Pension System (NPS)

The National Pension System (NPS) is a long-term, retirement-focused investment vehicle that offers some of the most attractive tax benefits in the country. While it is often grouped with Section 80C investments, its unique advantages place it firmly in the realm of advanced tax optimization.

The first benefit is under Section 80CCD(1), where your own contribution to your NPS Tier-I account is eligible for a deduction up to ₹1.5 lakh, which is part of the overall Section 80C limit. However, the real game-changer is Section 80CCD(1B). This provides an additional exclusive deduction of ₹50,000 for investments in NPS, over and above the ₹1.5 lakh limit of Section 80C. This effectively increases your total tax-saving potential to ₹2 lakh.

But the benefits do not stop there. If your employer contributes to your NPS account on your behalf, that amount is eligible for a deduction under Section 80CCD(2), and this deduction has no upper limit—it is allowed up to 10% of your basic salary (plus DA). This is a massive benefit that is often underutilized. Employees should actively check if their employer offers this and maximize it, as it reduces your taxable income without any outflow from your pocket.

The Home Loan Benefit: A Dual-Pronged Tax Saviour

For those who have taken the significant step of buying a house with a home loan, the tax benefits are substantial and work in two powerful ways, primarily under Section 24 and Section 80C.

Under Section 24(b), you can claim a deduction on the interest paid on your home loan. For a self-occupied property, the deduction limit is up to ₹2 lakh per financial year. This is a direct deduction from your income and can lead to massive tax savings, especially in the initial years of the loan when the interest component is high.

The second benefit is for the repayment of the principal amount of the loan. This is claimed under Section 80C and is part of the overall ₹1.5 lakh limit. Additionally, for first-time home buyers in affordable housing, Section 80EEA offers an additional deduction of up to ₹1.5 lakh on the interest paid, over and above the ₹2 lakh limit under Section 24, subject to certain conditions related to the loan amount and the value of the property.

The Leave Travel Allowance (LTA): A Tax-Free Holiday

The Leave Travel Allowance (LTA) is a component of your salary that is meant to cover the travel expenses for you and your family when you take leave. It is a tax-exempt allowance, which means you can claim an exemption for the actual travel cost incurred for two journeys in a block of four years.

The key point to remember is that LTA only covers the travel cost (air, rail, or public transport fare). It does not cover hotel expenses, food, or local transportation. You must provide your employer with the actual tickets or receipts as proof of travel to claim this exemption. The current block is 2022-2025, so it is essential to plan your vacations and submit the claims before the end of the financial year to avail of this benefit.

The Standard Deduction: A Simple and Automatic Relief

Introduced to simplify the tax filing process and provide uniform relief, the standard deduction is a flat deduction from your gross salary income. Currently, for the Financial Year 2023-24, a standard deduction of ₹50,000 is available to all salaried individuals and pensioners. This amount is automatically deducted when calculating your taxable salary, requiring no investment or proof. It is a straightforward benefit that reduces your taxable income right at the start.

Making the Right Choice: New Tax Regime vs. Old Tax Regime

A critical decision point for every salaried professional today is the choice between the old and new tax regimes. The new regime offers lower tax rates but requires you to forgo most of the deductions and exemptions we have discussed in this article, including HRA, LTA, and almost all investments under Chapter VI-A (like 80C, 80D, 80CCD(1B), etc.), except the standard deduction and a few others.

The old regime, with its higher slab rates, becomes beneficial if the total value of your deductions and exemptions is substantial. How do you choose? The answer lies in a simple calculation. You must compute your tax liability under both regimes. If the total of your HRA, LTA, 80C, 80D, NPS, and home loan deductions is significantly high, the old regime will likely be more advantageous. For someone with minimal investments and no home loan or HRA, the new regime might be better. Most employers now allow you to switch regimes each year, giving you the flexibility to choose based on your circumstances for that particular year.

Conclusion: Building a Holistic Tax Strategy

Tax optimization is not a year-end event; it is a continuous process that is woven into your financial life. By looking beyond Section 80C, you unlock a world of opportunities to enhance your savings and build a more secure financial future. It is about making informed choices—renting a home, buying health insurance, planning for retirement, or investing in a house—and understanding the tax benefits that accompany these smart life decisions.

Start by reviewing your salary slip. Talk to your HR department about your salary structure and allowances. Plan your investments and major expenses with a long-term perspective. By adopting these strategies, you transition from being a passive taxpayer to an active, strategic wealth manager for your own life. Remember, the goal is not just to save tax, but to use those savings to build a life of financial freedom and security.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Does Free Money Exist? The Real Story of How Your Passive Income Gets Taxed in India

01Does Free Money Exist? The Real Story of How Your Passive Income Gets Taxed in India -

02Your Journey to Financial Freedom: A Simple Guide to Building Passive Income in India

02Your Journey to Financial Freedom: A Simple Guide to Building Passive Income in India -

03Beyond the First Rupee: Building Your Personal System for Passive Income Success in India

03Beyond the First Rupee: Building Your Personal System for Passive Income Success in India -

04Your Extra Income Journey: Top Side Hustles to Boost Your Earnings in India

04Your Extra Income Journey: Top Side Hustles to Boost Your Earnings in India -

05The Right Way for Kids to Learn Technology: A Guide for Indian Parents

05The Right Way for Kids to Learn Technology: A Guide for Indian Parents -

06A New World at Your Fingertips: A Simple Guide to Technology Tutorials for Seniors

06A New World at Your Fingertips: A Simple Guide to Technology Tutorials for Seniors -

07Your Guide to Learning Technology in 2025: Simple, Smart, and Effective

07Your Guide to Learning Technology in 2025: Simple, Smart, and Effective