Now Reading: Your Money, Your Control: A Simple Guide to Personal Budgeting in India

-

01

Your Money, Your Control: A Simple Guide to Personal Budgeting in India

Your Money, Your Control: A Simple Guide to Personal Budgeting in India

Learn what personal budgeting is and why it is vital for financial security. This simple guide for Indians explains how a budget helps control spending, save for goals, reduce stress, and build a safety net for a more secure and peaceful future. Take control of your money today.

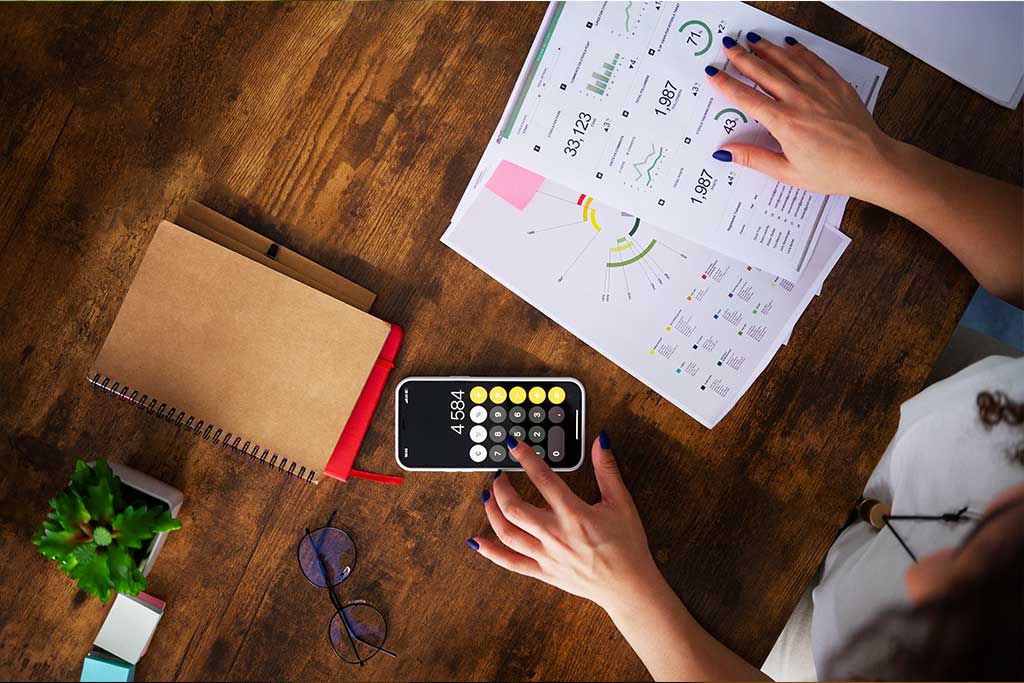

How often do we find ourselves wondering, “Where did all my money go by the end of the month?” This is a common feeling for many of us, from students receiving their pocket money to salaried professionals and those managing a household. Money seems to slip through our fingers, especially with rising costs of groceries, fuel, and entertainment. But what if there was a simple tool to break this cycle? There is, and it is called a personal budget.

Think of a budget not as a restriction, but as a map for your money. It is a simple plan that you create to track the money you earn and the money you spend. Just like you would not start a long journey without a map, you should not go through life without a plan for your finances. A budget gives you clarity, reduces stress, and most importantly, puts you in the driver’s seat of your financial life. This article will explain what a budget is in simple terms and why it is one of the most important habits you can develop for a secure and peaceful future.

What Exactly is a Personal Budget?

In the simplest words, a personal budget is a plan for your money. It is a way of writing down how much money you expect to get (your income) and how you will use it (your expenses) over a certain period, usually a month.

Your income includes your monthly salary, money from a side business, freelance work, or any other source of earnings. Your expenses are everything you spend money on, from big things like house rent and EMIs to small things like a cup of chai or an auto-rickshaw ride. The main goal of a budget is to ensure that your expenses do not exceed your income. It helps you live within your means and guides your money towards the things that truly matter to you, whether that is saving for your child’s education, buying a home, or going on a pilgrimage.

Why is Budgeting So Important for You?

You might think that budgeting is only for people who are struggling financially, but that is far from the truth. Everyone, regardless of their income level, can benefit from having a budget. Here is why it is so crucial, especially in the Indian context.

It Gives You Complete Financial Awareness

The first and most powerful benefit of a budget is that it opens your eyes. Most of us spend money without truly tracking it. Small, daily expenses like snacks, app subscriptions, and impulse buys add up to a significant amount by the end of the month. When you start budgeting, you become aware of every rupee. You finally see where your money is actually going, which is the first step towards making positive changes.

It Helps You Control Your Spending

Once you are aware of your spending patterns, you can start to control them. A budget acts as a spending guide. For example, you might decide you will only spend a certain amount on eating out each month. When you have a plan, you are less likely to make impulsive purchases. It encourages you to pause and think, “Do I really need this?” This control is the key to stopping money from leaking out unnecessarily.

It Empowers You to Reach Your Life Goals

All of us have dreams. Perhaps you want to build a corpus for your daughter’s wedding, make a down payment for a flat, buy a new car, or retire comfortably. These are financial goals. A budget is the tool that turns these dreams into achievable plans. By budgeting, you can allocate a specific amount of money each month towards your goals. You are essentially telling your money, “This much is for my future.” This systematic saving is what makes big dreams possible.

It Drastically Reduces Financial Stress

Money worries are a major source of stress and anxiety. The constant fear of running out of money before the next salary, or not being able to pay a bill, can be overwhelming. A budget fights this stress head-on. When you have a plan, you know that your essential expenses are covered. You gain peace of mind because you are proactively managing your finances instead of letting them manage you. This feeling of being in control is incredibly liberating.

It Prepares You for Emergencies

Life is unpredictable. A medical emergency, a sudden car repair, or a job loss can create a major financial crisis if you are not prepared. In India, we often rely on loans or help from relatives during such times. A budget helps you build an emergency fund—a savings buffer for exactly these situations. By setting aside a small amount each month, you can create a safety net that protects you and your family from life’s unexpected storms.

It Helps You Get Out of and Avoid Debt

Many people get trapped in a cycle of debt, using credit cards or personal loans to cover expenses when their salary runs out. High-interest debt from credit cards can be very difficult to escape. A budget helps you avoid this trap by ensuring you spend less than you earn. If you already have debt, a budget is your best friend. It helps you plan how to allocate extra money each month to pay off your loans faster, saving you a significant amount in interest payments.

How Can You Start Budgeting? It’s Simpler Than You Think.

You do not need a fancy degree or complicated software to start budgeting. The simplest method is often the most effective.

Track Your Income and Expenses

For the first month, just write down everything. You can use a simple notebook, a diary, or even a notes app on your phone. Every day, write down every single rupee you spend and every rupee you earn. Be honest and record everything. At the end of the month, you will have a clear picture of your financial habits.

Categorize Your Spending

Now, group your expenses into categories. Common categories include:

- Essential Needs: House rent, groceries, electricity bill, water bill, commute costs (fuel, bus/train fare), school fees.

- Financial Goals: Emergency fund savings, investments, children’s education fund.

- Lifestyle Wants: Eating out, movies, shopping for new clothes, vacations.

Create Your Plan for the Next Month

Using what you learned from your tracking, create a plan for the coming month. Decide how much money you will allocate to each category. The goal is to make sure your total planned spending and saving is less than or equal to your total income.

Review and Adjust

A budget is not a strict rule set in stone. It is a flexible guide. At the end of the month, review your plan. Did you spend too much on entertainment? Did you save less than you wanted? Do not get discouraged. Use this information to create a more realistic budget for the next month. It is a learning process.

You Can Do This: Take the First Step Today

Starting a budget might feel a little overwhelming at first, but the benefits are life-changing. It is a habit that pays off for a lifetime. You do not have to be perfect. The important thing is to start. Begin by tracking your expenses today. That one small step is the beginning of a journey towards financial freedom, security, and peace of mind. Remember, the goal is not to restrict your life, but to design it the way you want, one thoughtful rupee at a time.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Does Free Money Exist? The Real Story of How Your Passive Income Gets Taxed in India

01Does Free Money Exist? The Real Story of How Your Passive Income Gets Taxed in India -

02Your Journey to Financial Freedom: A Simple Guide to Building Passive Income in India

02Your Journey to Financial Freedom: A Simple Guide to Building Passive Income in India -

03Beyond the First Rupee: Building Your Personal System for Passive Income Success in India

03Beyond the First Rupee: Building Your Personal System for Passive Income Success in India -

04Your Extra Income Journey: Top Side Hustles to Boost Your Earnings in India

04Your Extra Income Journey: Top Side Hustles to Boost Your Earnings in India -

05The Right Way for Kids to Learn Technology: A Guide for Indian Parents

05The Right Way for Kids to Learn Technology: A Guide for Indian Parents -

06A New World at Your Fingertips: A Simple Guide to Technology Tutorials for Seniors

06A New World at Your Fingertips: A Simple Guide to Technology Tutorials for Seniors -

07Your Guide to Learning Technology in 2025: Simple, Smart, and Effective

07Your Guide to Learning Technology in 2025: Simple, Smart, and Effective