Now Reading: Beyond the First Rupee: Building Your Personal System for Passive Income Success in India

-

01

Beyond the First Rupee: Building Your Personal System for Passive Income Success in India

Beyond the First Rupee: Building Your Personal System for Passive Income Success in India

Move beyond random earnings. Learn to build a personalized system to manage, automate, and grow your passive income in India. This guide helps you audit your sources, define goals, and create a stable investment pyramid for long-term, stress-free wealth creation.

You have started this incredible journey. Perhaps you see a small dividend from your mutual funds, a steady interest from your fixed deposit, or the first payment from an online project you completed months ago. That first bit of money you did not actively work for is a wonderful feeling. It is a sign of possibility. But now, a more complex question appears: “What comes next?” Many people get stuck here. They have a few sources of income, but it feels scattered, unpredictable, and not quite like the powerful financial engine they dreamed of.

The difference between having a few random streams of passive income and achieving true financial freedom is not found in one magical investment. It is found in building a system. Think of it like the difference between having a few seeds and having a well-tended garden. A seed has potential, but a garden—with its rows, irrigation, and schedule for sunlight—produces a reliable harvest. Your passive income needs a similar structure. This article is not about finding new seeds; it is about how to design, build, and maintain your unique garden so it can feed you for a lifetime.

We will explore how to move from accidental earnings to intentional wealth. This involves auditing what you have, defining a clear purpose for your money, designing a personal investment framework, and learning the gentle art of maintenance. This guide is for every Indian who has taken the first step and is now wondering how to make the second, third, and hundredth step count.

The First Step: The Passive Income Audit – Knowing What You Have

Before you can build a system, you must take stock of what is already there. Many of us have bits of passive income flowing in from different corners without a clear picture of the whole. It is time to become the CEO of your own finances.

Set aside an hour, open a notebook or a spreadsheet, and list every source of passive income you have. This includes the interest from all your bank accounts and FDs, dividends from stocks and mutual funds, rental income, royalties, and affiliate income from a blog. For each source, write down three things: the approximate amount you earn from it per month or year, how consistently it arrives (is it monthly, quarterly, or erratic?), and how much effort it currently requires from you. This audit is not about judgment; it is about awareness. You cannot manage what you do not measure. This simple exercise will give you a clear, honest starting point for building your system.

Defining the Purpose: What is This Money For?

Once you know what you have, the next critical step is to decide where it needs to go. Passive income without a purpose often gets lost in daily expenses. You must give every rupee a job. This is a profound shift in mindset—from seeing this money as “extra” to seeing it as a dedicated employee.

Start by categorizing your financial goals. A simple way is to use three buckets:

- The Security Bucket: This money is for safety and capital preservation. Its purpose is to protect you from inflation and financial shocks.

- The Growth Bucket: This money is for aggressive wealth creation. Its purpose is to multiply over the long term, accepting some ups and downs along the way.

- The Freedom Bucket: This money is for funding your present and future lifestyle. Its purpose is to give you choices, like working less, pursuing a hobby, or traveling.

By defining these buckets, you are no longer just “reinvesting.” You are strategically deploying capital. For example, you might decide that all rental income goes to the “Security Bucket,” all dividends go to the “Growth Bucket,” and online income goes to the “Freedom Bucket” for your next vacation. This creates clarity and intention.

Designing Your Investment Framework: The Personal Pyramid

Now, with your audit complete and your purpose defined, you can design your personal investment framework. A helpful visual is a pyramid. A strong pyramid has a wide, solid base that supports the levels above.

The Base Layer (Security): This is the foundation of your passive income system, built for stability. Here, you will channel the money you have allocated to your “Security Bucket.” The goal is not high returns, but capital preservation and beating inflation. Ideal avenues for this layer include the Public Provident Fund (PPF), Senior Citizens’ Savings Scheme (SCSS), Debt Mutual Funds, and high-quality Corporate Fixed Deposits. This base layer ensures that no matter what happens in the stock market, your foundational wealth is safe and growing steadily.

The Middle Layer (Balanced Growth): This layer is about steady, disciplined growth without extreme risk. It forms the core body of your pyramid. This is where you might send the money from your “Growth Bucket.” The workhorse of this layer is the Systematic Investment Plan (SIP) in Hybrid Mutual Funds or Balanced Advantage Funds (BAFs). These funds automatically manage the mix of equity and debt, providing a hands-off way to grow your wealth. Index Funds, which simply track the market, are another excellent, low-effort option for this layer. The middle layer is for the patient investor who wants market-linked returns without the stress of daily stock picking.

The Apex Layer (Aspirational Growth): This is the smallest part of your pyramid, reserved for ideas with high growth potential. The money here should be from your “Growth Bucket” that you are emotionally prepared to see fluctuate, or even lose. This is the space for experimenting with sector-specific mutual funds (like technology or pharma), or for building a digital asset like a blog, a YouTube channel, or an app. The key here is that the failure of an investment in this layer should not impact the stability of your base and middle layers. It is for calculated, informed bets, not reckless gambling.

The Power of Automation: Making Your System Effortless

A system that requires daily willpower is a system that will eventually fail. The secret to long-term success with passive income is to make the process as automatic as possible. Technology is your greatest ally here.

Use automatic transfer facilities provided by your bank. Schedule a transfer from your main savings account (where your passive income lands) to your mutual fund SIPs or your PPF account a few days after you expect the income to arrive. Opt for the “Growth” option in your mutual funds so that dividends are automatically reinvested. Set up automatic bill payments for any expenses related to your passive income assets (like website hosting). By automating the flow of money, you remove temptation and ensure that your system runs smoothly in the background, much like a tree automatically draws water and sunlight to grow.

The Gentle Art of Maintenance: Review, Don’t Obsess

A garden needs occasional weeding and watering, not constant digging up of the seeds to see if they are growing. The same is true for your passive income system. You need a schedule for gentle maintenance, not daily obsession.

Commit to a semi-annual or annual “Financial Health Day.” On this day, you will not make rash decisions. You will simply review your pyramid. Look at your audit from six months ago and see how your income streams have performed. Check if your asset allocation (the balance between your Security, Middle, and Apex layers) is still in line with your goals. If your growth investments have done very well, they might have become a larger part of your portfolio than you intended. In this case, you might “rebalance” by taking some profits and moving them to your Security layer. This is a disciplined way of “buying low and selling high” without emotion.

Your Journey, Your System

Building a system for your passive income transforms it from a happy accident into a predictable, scalable part of your life. It shifts you from being a passive recipient to an active architect of your financial future. Remember, the perfect system is not a one-size-fits-all model; it is the one that you design for your own goals, risk tolerance, and life stage.

Start small. Begin with the audit. Define just one purpose for one stream of your income. Automate a single transfer. Each small step you take to organize your passive income is a step towards greater confidence and freedom. With a clear system in place, you are not just earning money passively; you are building a legacy actively.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

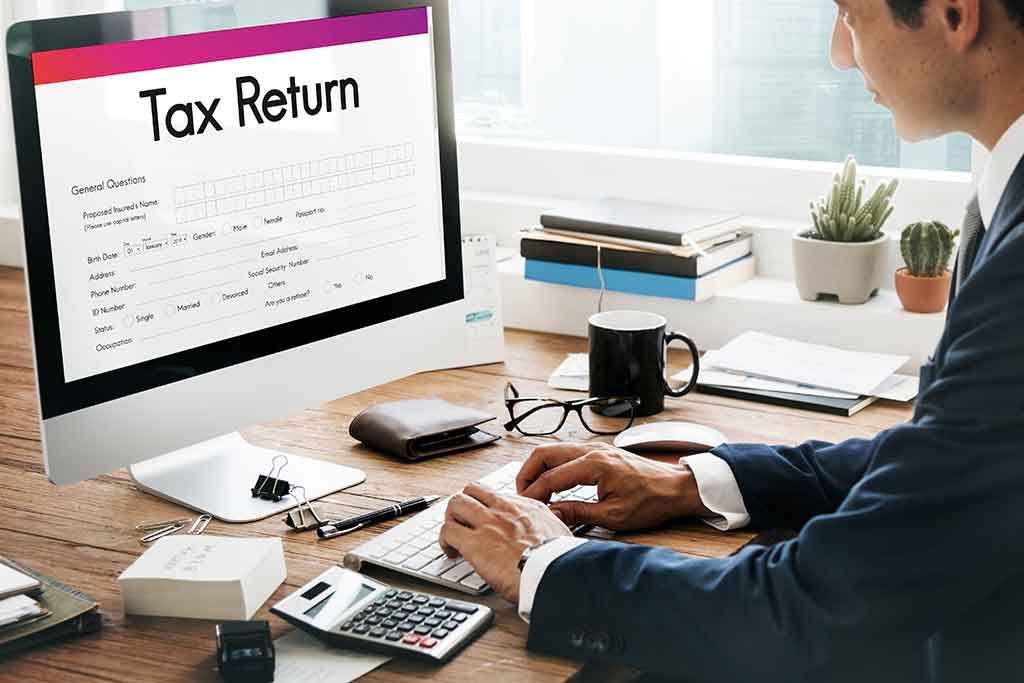

01Does Free Money Exist? The Real Story of How Your Passive Income Gets Taxed in India

01Does Free Money Exist? The Real Story of How Your Passive Income Gets Taxed in India -

02Your Journey to Financial Freedom: A Simple Guide to Building Passive Income in India

02Your Journey to Financial Freedom: A Simple Guide to Building Passive Income in India -

03Your Extra Income Journey: Top Side Hustles to Boost Your Earnings in India

03Your Extra Income Journey: Top Side Hustles to Boost Your Earnings in India -

04Beyond the First Rupee: Building Your Personal System for Passive Income Success in India

04Beyond the First Rupee: Building Your Personal System for Passive Income Success in India -

05The Right Way for Kids to Learn Technology: A Guide for Indian Parents

05The Right Way for Kids to Learn Technology: A Guide for Indian Parents -

06A New World at Your Fingertips: A Simple Guide to Technology Tutorials for Seniors

06A New World at Your Fingertips: A Simple Guide to Technology Tutorials for Seniors -

07Your Guide to Learning Technology in 2025: Simple, Smart, and Effective

07Your Guide to Learning Technology in 2025: Simple, Smart, and Effective